I have observed different crypto exchanges for quite some time now and analyzed the potential for different kinds of arbitrage. However, I don't quite understand what I am seeing.

Examples:

- Observing Poloniex and Binance web socket streams for the same symbol, it seems like most of the time Poloniex lags behind Binance but it generally moves the same way. Interestingly, these price movements occur without any (visible) trades happening. What could cause this effect? Who makes money from this if there are no trades?

- Triangular arbitrage rarely seems profitable within one exchange. I would expect that multiple symbols on a smaller exchange like Poloniex would need some time to return to balance after a major price movement. However, it seems like markets adjust faster than the real-time web socket API will let me look at the situation (1ms latency).

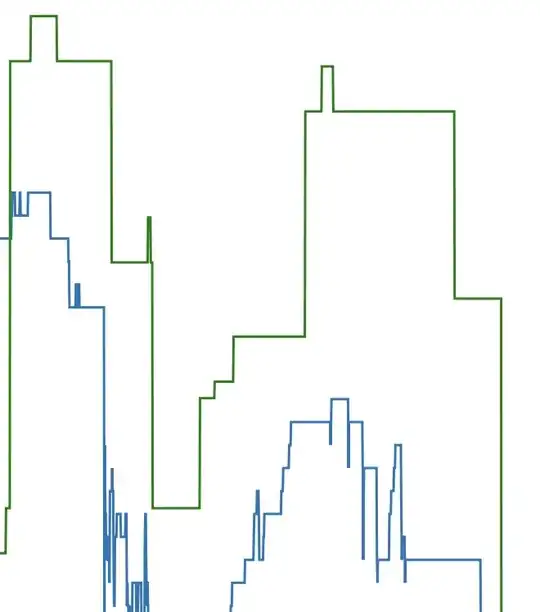

The attached image (sorry, didn't find a bigger one in my files) shows Binance (blue) and Poloniex (green) prices moving. There are no trades on Poloniex during this time.